How to Consolidate Debt Effectively: Debt consolidation is a powerful strategy for managing and reducing multiple debts. By combining various debts into a single loan or payment plan, you can simplify your financial obligations and potentially lower your overall interest rates. This article explores effective methods for consolidating debt, their benefits, and tips to ensure successful consolidation.

Understanding Debt Consolidation

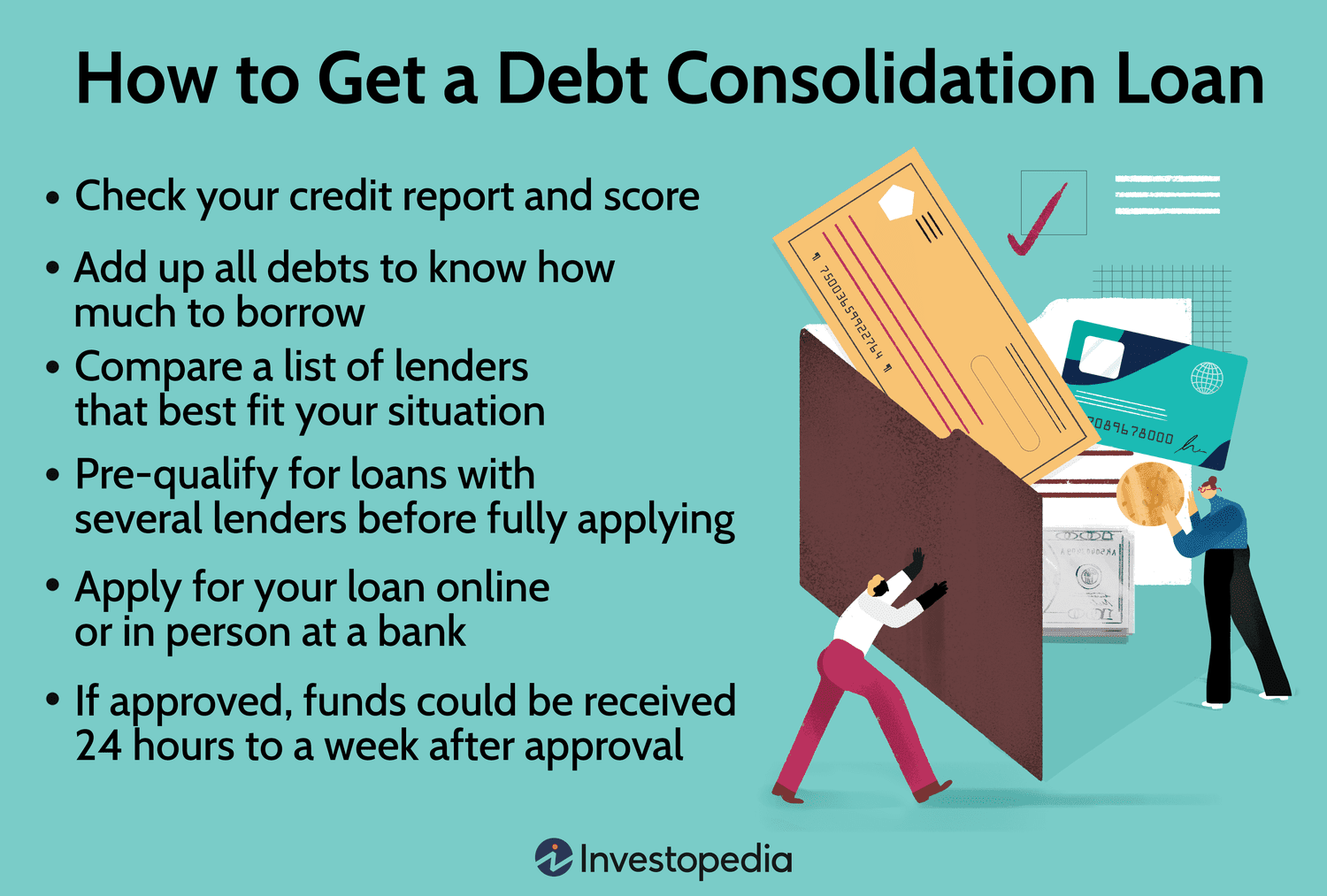

What is Debt Consolidation?

Debt consolidation involves combining multiple debts into a single loan or payment plan. This process helps streamline your finances, making it easier to manage payments and potentially reduce your interest rates. By consolidating, you can replace several high-interest debts with one lower-interest loan, thereby reducing your monthly payments and total interest costs.

Types of Debt Consolidation

There are several methods for consolidating debt, each with its own advantages and considerations:

- Balance Transfer Credit Cards: Transfer existing credit card balances to a new card with a lower interest rate or an introductory 0% APR period.

- Personal Loans: Obtain a personal loan to pay off multiple debts, often with a fixed interest rate and monthly payment.

- Debt Management Plans (DMPs): Work with a credit counseling agency to consolidate your debts into a single monthly payment, often at reduced interest rates.

- Home Equity Loans: Use the equity in your home to secure a loan for consolidating debts, typically with lower interest rates but involving your home as collateral.

Benefits of Debt Consolidation

Simplified Payments

One of the primary benefits of debt consolidation is the simplification of your financial management. By consolidating multiple debts into a single payment, you only need to keep track of one due date and one payment amount. This streamlined approach reduces the risk of missing payments and helps you stay organized.

Moreover, consolidating debt can eliminate the need to juggle multiple credit card balances and due dates, making it easier to manage your overall financial situation.

Lower Interest Rates

Debt consolidation can potentially lower your interest rates, especially if you qualify for a balance transfer credit card with a 0% APR offer or a personal loan with a lower rate than your existing debts. Hence, this reduction in interest rates can lead to significant savings over time.

In addition, lower interest rates help reduce your monthly payments and the total amount paid over the life of the loan, improving your overall financial health.

Improved Credit Score

Effectively consolidating debt can positively impact your credit score. By paying off high-interest credit cards and maintaining a lower credit utilization ratio, you can boost your credit score. Furthermore, consistent and timely payments on your consolidation loan contribute to a positive credit history.

Thus, a higher credit score opens up better financial opportunities and terms for future credit.

Tips for Effective Debt Consolidation

Evaluate Your Options

Before consolidating, thoroughly evaluate your options to determine the best method for your situation. Compare interest rates, fees, and terms for different consolidation methods, including balance transfer cards, personal loans, and DMPs. In addition, consider the impact of each option on your credit score and financial goals.

Create a Budget

Developing a budget is crucial for managing your finances effectively after consolidation. Create a detailed budget that includes your new consolidated payment, along with your regular expenses and savings goals. Therefore, sticking to a budget helps ensure you can meet your monthly obligations and avoid accumulating new debt.

Avoid Accumulating New Debt

After consolidating, it’s important to avoid accumulating new debt. To add on, focus on building a solid financial foundation by saving and avoiding unnecessary expenditures. Use your newly consolidated payment plan as an opportunity to develop healthier financial habits and avoid falling back into debt.

Seek Professional Advice

Consider seeking advice from a financial advisor or credit counselor to guide you through the consolidation process. These professionals can provide valuable insights and help you choose the most suitable consolidation method based on your financial situation.

Potential Drawbacks

Fees and Charges

Some debt consolidation methods come with fees and charges that can impact your overall savings. For example, balance transfer credit cards may have transfer fees, and personal loans may include origination fees. Therefore, it’s essential to factor these costs into your decision-making process and ensure that the benefits of consolidation outweigh any fees.

Impact on Credit Score

While debt consolidation can improve your credit score over time, it may have a temporary impact. For instance, applying for new credit or a personal loan can result in a hard inquiry on your credit report, potentially causing a slight dip in your score. However, maintaining timely payments and responsible credit use will lead to long-term improvements.

Conclusion

In conclusion, debt consolidation is a valuable strategy for simplifying your financial management, potentially lowering interest rates, and improving your credit score. By evaluating your options, creating a budget, avoiding new debt, and seeking professional advice, you can effectively consolidate your debt and achieve greater financial stability.

Ultimately, successful debt consolidation involves careful planning and commitment to managing your finances responsibly. With the right approach, you can overcome financial challenges and build a healthier financial future.