Achieving financial security requires smart investing and thorough financial planning. By understanding key investment principles and creating a comprehensive financial plan, you can grow your wealth and work towards your financial goals. This article provides practical investment tips and financial planning strategies to help you build a secure financial future.

Understanding the Basics of Investing

Investing is the process of allocating money to assets or ventures with the expectation of generating returns over time. It involves a balance of risk and reward, and understanding the basics is crucial for making informed decisions.

Setting Clear Financial Goals

Short-Term Goals

Short-term financial goals are those you aim to achieve within the next one to three years. These might include building an emergency fund, saving for a vacation, or paying off high-interest debt. Setting clear short-term goals helps you focus your financial efforts and measure progress.

Long-Term Goals

Long-term financial goals extend beyond three years and often involve significant life events such as buying a home, funding children’s education, or saving for retirement. Defining your long-term goals provides direction for your investment strategy and helps you stay committed to your financial plan.

Diversifying Your Investment Portfolio

Asset Allocation

Asset allocation is the process of dividing your investments among different asset categories, such as stocks, bonds, and real estate. This strategy helps spread risk and increase the potential for returns. The right mix depends on your risk tolerance, financial goals, and investment horizon.

Risk Management

Diversification is key to managing investment risk. By spreading your investments across various assets and sectors, you can mitigate the impact of poor performance in any single area. Regularly review and adjust your portfolio to maintain a balanced and diversified approach.

Investing in Stocks

Understanding Stocks

Stocks represent ownership in a company and entitle you to a share of its profits. Investing in stocks can offer significant growth potential but also involves higher risk compared to other asset classes.

Stock Market Research

Conduct thorough research before investing in stocks. Analyze company financials, industry trends, and market conditions. Utilize resources such as financial news, analyst reports, and stock screening tools to make informed decisions.

Investing in Bonds

Understanding Bonds

Bonds are debt securities issued by governments or corporations to raise capital. When you invest in bonds, you lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered lower-risk investments compared to stocks.

Types of Bonds

There are various types of bonds, including government bonds, corporate bonds, and municipal bonds. Each type carries different levels of risk and return. Assess your risk tolerance and investment goals to choose the right bonds for your portfolio.

Exploring Real Estate Investments

Real Estate Benefits

Investing in real estate can provide steady income through rental properties and potential appreciation in property value. Real estate also offers diversification benefits and can act as a hedge against inflation.

Real Estate Investment Strategies

Consider different real estate investment strategies such as buying rental properties, investing in real estate investment trusts (REITs), or participating in real estate crowdfunding. Each strategy has its own risk and return profile, so choose the one that aligns with your financial goals and risk tolerance.

The Importance of Retirement Planning

Starting Early

The earlier you start saving for retirement, the more time your money has to grow. Take advantage of compound interest by contributing regularly to retirement accounts such as a 401(k) or IRA.

Retirement Accounts

Understand the different types of retirement accounts available to you. Employer-sponsored plans like 401(k)s often come with matching contributions, while IRAs offer tax advantages. Maximize your contributions to these accounts to build a substantial retirement fund.

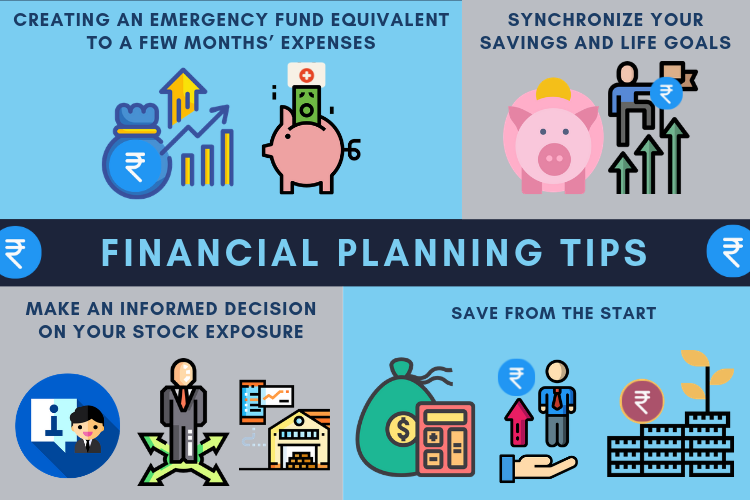

Financial Planning Tips

Create a Budget

A well-structured budget is essential for managing your finances and allocating funds to your investments. Track your income and expenses, and identify areas where you can cut back to increase your investment contributions.

Build an Emergency Fund

An emergency fund provides financial security in case of unexpected expenses. Aim to save three to six months’ worth of living expenses in a separate, easily accessible account.

Seek Professional Advice

Consider working with a financial advisor to create a personalized financial plan. A professional can help you navigate complex investment options, optimize your portfolio, and stay on track with your financial goals.

Conclusion

In conclusion, investing wisely and planning your finances effectively are crucial steps towards building a secure financial future. By setting clear goals, diversifying your portfolio, and taking advantage of retirement accounts, you can grow your wealth and achieve your financial aspirations. Start today and take control of your financial destiny.